In today’s digital landscape, the financial world has undergone a remarkable evolution. We live in an era where financial transactions, right from sending salaries to paying bills, have migrated into the virtual realm with unprecedented speed and convenience. For businesses seeking reliable payroll solutions, Abu Dhabi or the rest of the UAE, it’s more important than ever to partner with providers who prioritize security and fraud prevention.

However, where you have innovation, you will also have someone trying to exploit that innovation. So, in spite of revolutionizing the way businesses and individuals transfer money today, a growing threat of fraudulent calls and phishing attempts looms large. This is where financial literacy plays a crucial role in mitigating fraud risks.

Why we need financial literacy

Even though UAE and Saudi Arabia are considered the region’s safest nations, attracting countless companies to their low-threat business ecosystems, reported cases of fraudulent calls surged by at least 62% in the past year. The UAE government runs a multitude of awareness campaigns, urging its citizens to stay prudent and well informed, focusing on how the true power of information lies in the hands of the people who wield it.

As more individuals embrace the ease of digital remittances, there’s always a risk of cybercrimes owing to quicker payment systems, technological advancements like AI-enabled deepfakes, and the evolving fraud techniques. In this regard, it becomes crucial for businesses as well as individuals to stay financially literate and make informed financial decisions.

Where does fraud happen?

Today, we give out our mobile numbers at several places – you eat at a restaurant, tap your card in a cab, make a purchase at a store, or even if you sign up with a bank. Access to such data has become so easy. That’s when the spam calls begin.

Fraudsters misuse such data for their own benefit and will try to reach out to you through phone, SMS, social media, fake websites, or Whatsapp (with real-looking logos of bank, official entities or even the government) saying you need to click on a link or confirm some of your details, or read out an OTP.

When you’re settling in a different country, there are a number of application processes that you could be a part of. As an expatriate in the UAE, you may need to apply for a work permit, medical test, health card, Emirates ID card, insurance, and finally, your debit/credit card. In the middle of any of these processes, if someone claiming to be from the Police or if an official authority calls you and tells you to share the OTP that you just received (in a stern voice), you probably will out of fear. It is important to remember to stay vigilant, and not give out any information, no matter what.

Financial Literacy at Edenred

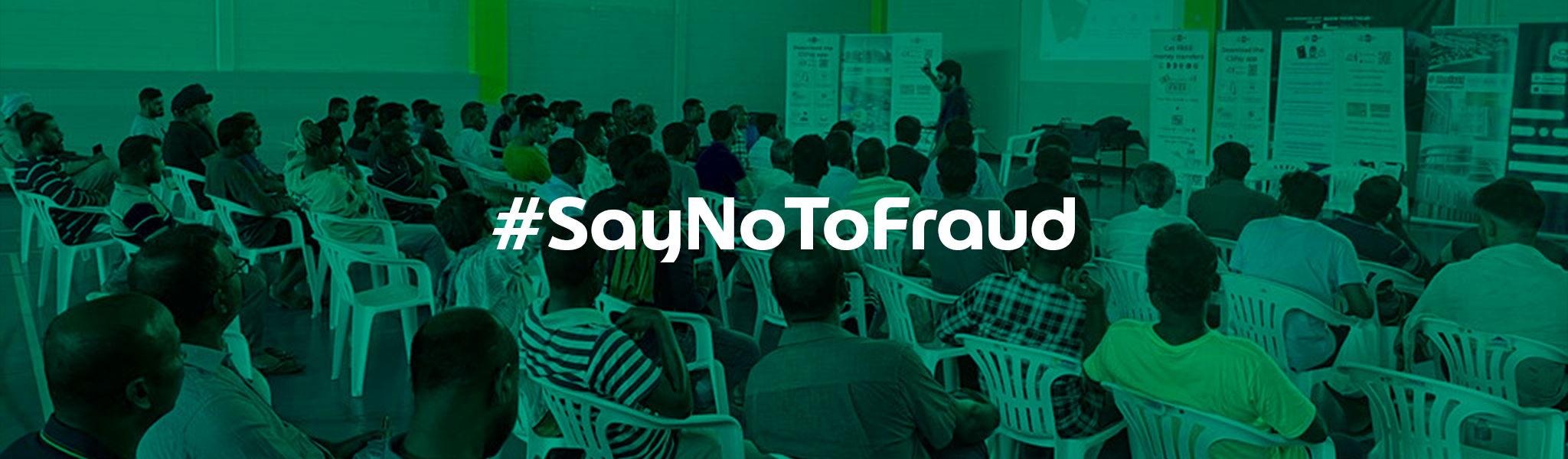

As a payroll services company that compassionately works toward empowering the migrant workforce of the UAE, we not only have a number of digital and financial trainings in place to help our customers manage their money better, but we also work hard on educating them about digital thefts and fraud awareness.

Some of our awareness and prevention initiatives include:

- Field visits and in-person trainings

- Posters and roll-up banners in the accommodations or in-house ATMs

- C3Pay app notifications

- Edenred portal notifications

- Financial literacy videos

- SMS campaigns

- Email campaigns

- Social media content

- Online/offline marketing collaterals that ask people not to share their personal information, or with product-related FAQs, such as – How do you find your PIN, How do you block your C3Pay card, How do you subscribe for Unemployment Insurance, etc.

Some of these initiatives are also combined with educating our customers and their Employee Benefit Officers to not share personal information anywhere and/or with custom trainings that are delivered with a lot of love and care by our rock-solid Operations team, passionately headed by Mr Suresh Kumar, and are further supported by our multilingual Customer Service team, skillfully steered by Mr Abdullah Khan.

Our mission is to break down the barriers to financial empowerment and change the way the world defines financial freedom. To do so, the team visits at least 7-9 accommodations every week to interact with our customers in person and addresses online queries coming from at least 67,000 people on a monthly basis.

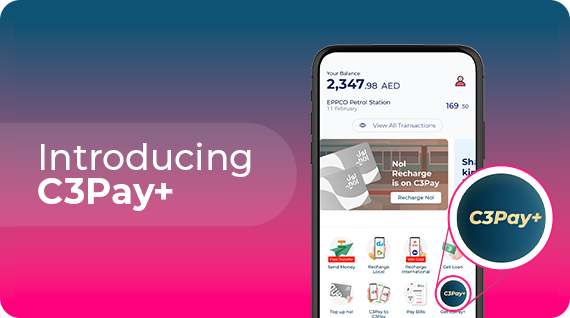

Safety measures on the C3Pay app

As part of our endeavour to ensure they remain protected from telephonic or online fraud, our app notifications continue to remind them to keep their money and data safe. Here are some of the other features that promote their safety and security:

1) Our customers are notified every time their card is used, so they have the option of blocking their C3Pay card immediately from the app in case of any suspicious activities.

2) Our customers’ ATM pin is for their eyes alone. Only they are allowed to access their PIN when they receive their card and when they sign up on the app. This process includes verifying their identity, so it’s secure.

3) Transactions are OTP-based, and all the OTPs only go to their registered mobile number, so no one else can make transactions on their behalf. Moreover, the mobile number can be edited on the app so they have the power to update their credentials.

4) There is a 24/7 Customer Support team who assists our customers with all their queries (such as how to block, where can I find, etc) across 6 languages.

5) The cybersecurity team ensures that all our apps remain secure, thereby preventing cyber-attacks and keeping all our customers’ data safe.

For better and safer money management, we encourage our customers to use their money digitally, and not carry it around in cash. To facilitate this, they have the option of sending money to their home country, doing mobile recharges or peer-to-peer money transfers through the C3Pay app itself. Through such measures, we hope to improve digital and financial literacy.