If you manage payroll in UAE for your employees, you’ve probably heard of WPS. But if this is your first time, let’s run you through it.

If you are especially looking for information related to WPS Abu Dhabi, this guide will provide a comprehensive overview.

What is WPS?

WPS stands for the Wages Protection System. The Wages Protection System is a system of electronic salary transfer that makes sure companies pay their employees through a WPS agent such as a bank, exchange house, financial institution or company like Edenred to guarantee timely and accurate payment of wages to your employees.

Why was it introduced?

Prior to 2009, there was no way to track how employees in the UAE were paid, whether they were paid on time or not paid at all.

So, in 2009, the Government of UAE introduced the Wages Protection System (WPS) by means of the Ministerial Decree No. 739 in 2016 and additional regulations introduced in September 2019. It became mandatory for companies to process their employees’ salaries through an electronic salary transfer system regulated by the Ministry of Human Resources and Emiratization (MOHRE) and the Central Bank of UAE.

WPS ensured that companies could easily pay their employees transparently, without much effort, protect their rights by law, and as a result, reduce disputes between employers and employees, thereby resulting in unfair practices, salary delays, use of illicit funds, and a better employer-employee relationship.

Which companies are required to comply with WPS regulations?

All companies in the UAE registered with the Ministry of Human Resources and Emiratization (MOHRE) across all sectors and industries as well as companies in certain free zones such as Jebel Ali Freezone (JAFZA) and Dubai Multi Commodities Centre (DMCC) must comply with the WPS regulations.

All companies registered under the following authorities:

How does it work?

In order to process salaries through WPS, you must have a contract with a WPS agent such as bank, exchange house, financial institution or Edenred that’s registered with the MOHRE. After you have run payroll from your side, your WPS agent will be responsible for the payment of wages to your employees.

Here’s how WPS works:

1. Registration

First you need to register on the MOHRE website and set up your account with your login credentials.

You will need to provide the following:

- Your corporate bank account information.

- An employee list with details of the WPS agent your company processes salaries with. They should be registered with MOHRE.

- The bank or payroll card your employees receive salaries with.

- The date on which salaries need to be paid.

2. Transfer of salaries

After you’ve created your account, you need to create and submit the Salary Information File (SIF). The Salary Information File (SIF) is an excel sheet with the employee list and the details of the WPS agent your company processes salaries with.

When creating a SIF, the information you need are:

- The wages or salaries (basic salary, deductions, allowances, overtime payment, additional bonus, among others) of each employee, i.e., the employee details record (EDR)

- The 14-digit labour card number in the card issued by the MOHRE when the employee visa is secured

- Your bank routing code, which you would have received from the bank, exchange houses, or Edenred.

- Employee bank account number (IBAN)

- Start date of salary

- End date of salary

- Number of days salary paid

- Basic or fixed salary

- Variable salary

- Number of leaves per year

Every time you want to pay salaries, you must fill out and submit the SIF on the WPS. You need to export the excel file as .CSV and then rename it as .SIF while saving it.

It’s important to ensure there are no errors in your SIF to get quick validation from the Central Bank and MOHRE. With Edenred Payroll you don’t have to worry about this, we’ll ensure your file is correct and follows all the guidelines.

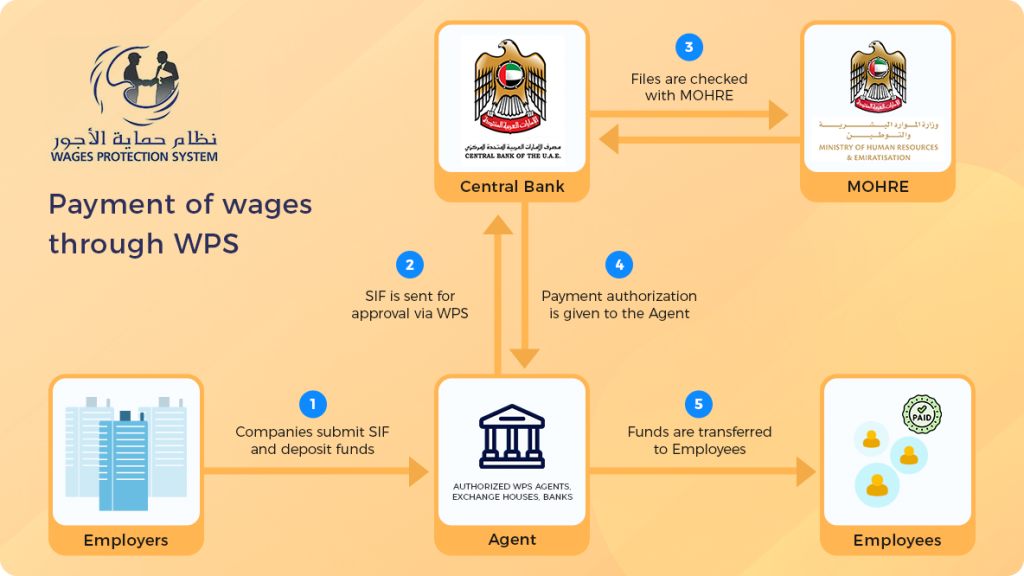

3. Payment of Wages

WPS salary check by the MOHRE and the Central Bank

After submitting the SIF to the WPS, the MOHRE and Central Bank will verify that all the details you submitted in the SIF are accurate and in compliance with the WPS requirements.

These are some mandatory rules to meet the WPS requirements while processing salaries:

- At least 80% of all employees must be paid (excluding some unpaid leave).

- Employees must be paid 80% or above of their salary (apart from some salary deductions).

- Employees must be paid their salary for a month latest by the 15th of the next month. If not, employers will be considered late in paying unless otherwise specified in the employment contract. For example, an employee’s salary for the month of June must be paid latest by the 15th of July.

- Do not skip paying any contracted employee’s salaries for 3 consecutive months.

- Make sure that you pay any bank fees, expenses, or provider fees related to the payment.

Authorization by WPS

If the Central Bank approves your salary check, they will issue a payment order to your WPS agent. If there are any mistakes in the SIF, you will receive an email asking you to update the SIF to correct the errors. Avoiding errors would ensure you don’t get fines or penalties for payment delays.

Transferring money to your employees

After your WPS agent receives the payment order, they will transfer the money to your employees. If you are partnered with a company like Edenred UAE, your employees will receive their salaries safely and securely in a WPS payroll card called C3Pay.

Summary

- The Wage Protection System (WPS) was introduced to protect employees’ rights by ensuring secure and timely payment of salaries through an electronic salary transfer system.

- All companies registered with the MOHRE and in certain freezones must follow WPS.

- How does the WPS work:

- Register your company with the MOHRE.

- Create and submit the SIF to WPS through a WPS agent such as Edenred UAE

- Ensure you follow the WPS guidelines, and your SIF does not have any errors, so salaries are transferred easily.