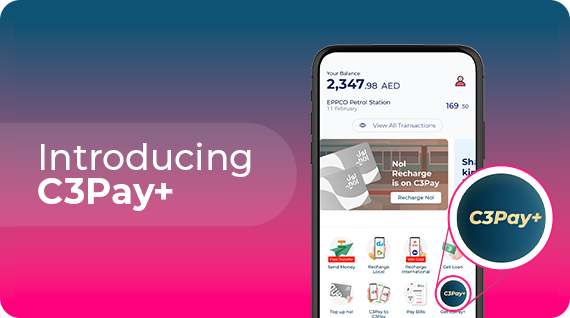

When managing a business and a workforce in the United Arab Emirates, managing payroll can be a complex and time-consuming task. This is especially true when considering the various payment options available, such as opting for Edenred Payroll, C3Pay payroll card or a RAK Bank salary card, which can be a valuable tool for certain employees. For this reason, many companies turn to payroll service providers to streamline their payroll processes, ensuring accurate and on-time payments for their employees.

However, selecting the right payroll provider is a crucial decision that has the potential to impact your workforce, operations, compliance, and productivity in general. Let’s explore some of the key factors to consider when choosing a payroll provider in the UAE.

✅ Local Compliance Expertise

UAE’s labour laws are unique and subject to frequent changes. The payroll provider you pick, should have in-depth knowledge of local employment laws, including those related to wages, working hours, and end-of-service benefits. This expertise is vital to ensure that your payroll remains compliant with the latest regulations.

✅ Data Security

Payroll involves handling sensitive employee data, such as salary information and personal details. It’s imperative that your payroll provider has robust data security measures in place to protect this information from unauthorized access or breaches. They must be compliant with the country’s data protection regulations.

✅ Accuracy and Timeliness

Accurate and on-time payroll processing is essential for employee satisfaction and compliance. Your provider should have a track record of error-free payroll, ensuring that your employees are paid correctly and on time, every month.

✅ Customer Support

Consider the level of customer support and accessibility provided by the payroll provider. When issues arise, you want a provider that is responsive, accountable, and readily available to address your concerns. Factors such as their customer support hours, channels, size of team, and number of languages offered, also matter.

✅ Reputation and References

Do your background research on the payroll provider’s reputation within the UAE business community. Seek references from other businesses they’ve served and feedback from existing clients, who can provide valuable insights into their service quality. In addition to this, their certifications, accreditations, and customer reviews are testament to their knowledge, expertise, and track record.

✅ Transparency in cost

Budgeting is crucial for any business. Ensure that the pricing structure of your payroll provider is transparent, with no hidden fees. This clarity helps you plan your finances effectively.

✅ Good value for money

Pricing isn’t everything, but it surely makes a difference to work with an industry-mature partner who offers good value for the services they provide.

✅ User-friendly interface

Payroll isn’t just about calculations of salaries. A well-designed UI/UX can definitely turn a complex task into a seamless, hassle-free experience for your entire team.

✅ Scalability

In view of your business’s growth potential, a good payroll provider should be able to scale its services alongside your business, while being able to accommodate an increasing number of employees and additional complexities.

✅ Future-Readiness

The financial world is ever evolving, with technologies such as AI and automation becoming increasingly important. Ensure that the provider you pick is forward-thinking and adaptable to emerging trends and technologies.

To conclude, choosing the right payroll provider in the UAE is a critical decision that directly impacts your employees and could have financial as well as legal implications.

By considering the listed factors, you can make an informed choice that will benefit your company for years to come. Payroll outsourcing, when done right, not only saves time but also ensures peace of mind, allowing you to focus on your core business operations.

For more information related to WPS payroll, management of payroll cards, or your employees’ financial rights, feel free to reach out to us on info.ae@edenred.com